Wind mitigation refers to adding features to a home that help withstand or increase resistance to high winds caused by major storms or hurricanes.

Homeowners living in areas prone to such weather events can significantly save insurance premiums and enhance the property’s and its occupants’ safety.

What is a Wind Mitigation Inspection?

A wind mitigation inspection assesses a home’s wind-resistant features and can result in improvement recommendations. It is a visual examination, often requiring access to the attic to view the underside of the roof and other structural elements.

These inspections can provide homeowners with the necessary documentation to qualify for insurance discounts and guide them in making their homes more resistant to wind damage.

A certified professional typically performs this inspection, such as a licensed general contractor, building contractor, architect, engineer, building inspector, or home inspector.

Who Needs a Wind Mitigation Inspection?

Wind mitigation inspections are crucial for homeowners in areas prone to hurricanes and high winds, such as Florida, the eastern seaboard, and Gulf Coast states.

These inspections are advisable if you are considering buying a new home, seeking to lower your homeowner’s insurance premium, or have recently made improvements to your home.

Some insurance companies in hurricane-prone states (like Florida) will not offer home insurance coverage without proper wind mitigation features.

Why Wind Mitigation Inspections Matter for Home Insurance

Wind mitigation inspections can significantly impact home insurance premiums. In Florida, for example, People’s Trust Insurance Company says that 15% – 70% of home insurance premiums can be attributed to wind damage risk.

By identifying and documenting features that increase a home’s resistance to wind, these inspections can qualify homeowners for discounts on their insurance premiums.

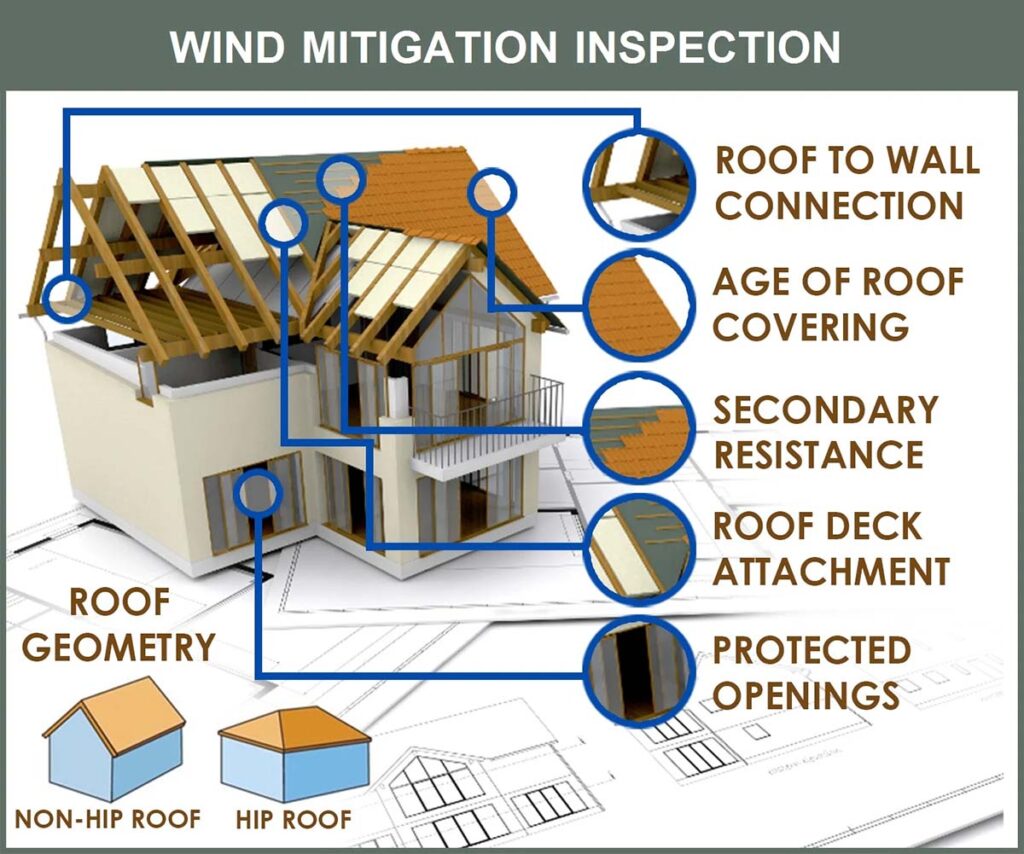

What Does a Wind Mitigation Inspection Include?

A wind mitigation inspection focuses on key features and add-ons that reduce the damage your home may sustain during a windstorm.

The inspection covers several key components of your building, including:

- Roof Coverage Assessment: The inspector assesses the installation date of the roof and its compliance with applicable building codes.

- Roof Decking Attachment: The examination focuses on identifying the material used for roof decking and its attachment method to the structure beneath, such as using nails or staples. If nails are employed, their length and spacing are also recorded.

- Connection from Roof to Wall: Attention is given to how the roof is fastened to the walls, including whether nails or hurricane straps are used and the type of ties (single or double). A more securely fastened roof can lead to more substantial insurance discounts.

- Roof Shape Configuration: The shape of the roof, whether hip, gable or another design, is evaluated. A hip roof, which slopes on all sides like a pyramid, often qualifies for insurance discounts.

- Gable End Support: The inspector checks if gable ends are reinforced according to Florida Building Code standards for gable roofs. Gable ends over 48 inches in height require bracing as a criterion for insurance discounts.

- Wall Construction: The home’s framing, reinforcements, and exterior finish materials are reviewed to determine the potential for insurance discounts. Homes with steel-reinforced concrete block construction may receive higher discounts than those with plywood frames and synthetic siding.

- Roof’s Secondary Water Resistance: Inspectors look for a secondary water barrier on roofs, especially relevant for roofs installed or renovated after 2008. Photographic evidence is typically needed to qualify for discounts in this category.

- Protection of Openings: The focus here is on the presence of shutters and other protective devices against wind-driven debris for doors and windows, including their ratings (e.g., hurricane-rated). All openings must be equipped with hurricane-rated protection to qualify for a discount.

- Windows and Doors: The inspector checks for window protection measures like shutters or impact-resistant glazing and the wind resistance of doors.

- Garage Door: The garage door’s wind resistance is evaluated, and the inspector may recommend upgrades or reinforcements if necessary.

How Much Does a Wind Mitigation Inspection Cost?

On average, a wind mitigation inspection costs between $75 and $150, with most people paying around $100. However, this rate can be much higher depending on the house size and location.

Wind mitigation inspections are often offered at a discounted rate when included as an ancillary inspection to a complete home inspection. A stand-alone wind mitigation inspection can cost $250 to $500 or more.

Roof Mitigation Techniques

A strong roof is a critical component of wind mitigation. Techniques include:

- Water Barriers: Sealing the roof deck prevents water intrusion if shingles blow away during extreme winds.

- Roof to Foundation Anchoring: Reinforcing the home’s walls to the roof and foundation to establish a continuous load path, enabling the outer structure to resist strong winds.

- Roof Coverings: Using roofing materials and installation that meet local building codes to withstand high wind speeds.

Window and Door Coverings

Windows and doors are vulnerable points during high winds. Protection methods include:

- Impact Glass Windows: Investing in impact glass windows can improve a home’s overall energy performance, security, value, and comfort while potentially saving on homeowner’s insurance.

- Hurricane Shutters: Installing hurricane shutters on windows to reduce the risk of damage.

- Opening Protection: Ensuring all exterior entries and glazed exterior openings are protected with wind-resistant features that meet local standards.

Garage Door Wind Mitigation

The garage door is often the largest opening in a home and needs adequate protection:

- Wind Load Struts: Adding wind load struts to the back of the garage door to support its weight and prevent it from being pushed in by high winds.

- Wind-Resistant Doors: Most modern garage doors are designed to be wind-resistant, but older doors may require upgrades or replacement with heavier-gauge materials.

Benefits of Wind Mitigation

- Insurance Savings: Homeowners can receive discounts on insurance premiums for implementing wind mitigation features. Discounts can be as much as 45% off the annual insurance premium.

- Enhanced Safety: Reducing the risk of damage to the property and injury to occupants during severe weather events.

- Increased Home Value: Improving the resilience of the home can increase its market value and appeal to potential buyers.

Cost of Wind Mitigation Improvements

The cost of adding wind mitigation features to a home can vary widely depending on the specific features being added, the size and location of the house, and the local labor and material costs. Here are some general cost estimates based on the search results:

- Roofing Enhancements: The cost of improving the roof deck attachment or installing a new roof covering can vary significantly depending on the size of the roof and the materials used. For example, hiring a local roofer for a roof replacement can cost between $45 and $75 per hour.

- Window and Door Reinforcements: The cost of installing impact-resistant glass or window shutters varies widely. The price will depend on the number and size of the windows and doors, the specific products chosen, and the labor costs in your area.

- Structural Additions: The cost of adding structural enhancements like gable end bracing or a secondary water-resistant barrier will depend on the size and complexity of the job.

- Opening Protections: The cost of adding storm shutters or panels to protect windows and other openings can vary based on the number and size of the openings and the specific products chosen.

- Topography Considerations: The cost of making changes to the property’s topography to mitigate wind impact can vary widely depending on the specific changes needed and the size of the property.

These costs can be significant, but they are often offset by the potential savings on homeowners’ insurance premiums. In many cases, homeowners’ discounts on their insurance premiums can more than makeup for the cost of the wind mitigation features.

Many states offer discounts, grants, or tax credits to homeowners investing in wind-resistant features. These incentives are designed to offset the cost of improvements and encourage homeowners to enhance their homes’ resistance to wind damage.

How to Find a Wind Mitigation Inspector

To find a certified inspector for a wind mitigation inspection, you can consider the following resources:

- InterNACHI: The International Association of Certified Home Inspectors (InterNACHI) offers members a free online Wind Mitigation Inspection Course. Florida-licensed home inspectors who complete this course qualify for wind mitigation inspections. InterNACHI maintains a list of individuals who have passed their course.

- Citizens Property Insurance Corporation: This organization states that any authorized inspector can conduct your wind mitigation inspection and complete the necessary form.

- HomeTeam Inspection Service: This company offers wind mitigation inspections, and their reports are certified for 5 years after the inspection.

- Florida Association of Building Inspectors (FABI): FABI offers education on wind mitigation inspections. You can contact them for more information or find a certified Florida inspector.

- My Safe Home Inspection: This company offers wind mitigation inspections from licensed and certified inspectors. They also have an in-house quality assurance program.

- VYRD: This company can provide you with contact information for third-party wind mitigation inspectors. They also mention the My Safe Florida Home program, which provides qualifying homeowners free wind mitigation home inspections.

Wind Mitigation Inspection vs. 4-Point Inspection vs. Full Home Inspection

Wind Mitigation Inspection, 4-Point Inspection, and Full Home Inspection are distinct types of evaluations, each serving different purposes in the realm of home ownership and insurance. Here’s how they compare:

Wind Mitigation Inspection

Specifically, it assesses a home’s features contributing to its resistance against wind damage from storms or hurricanes. It focuses on the structural and construction aspects that mitigate the effects of high winds.

- Key Areas Examined: Roof shape and construction, roof-to-wall connections, secondary water resistance, protection of openings (such as windows and doors with impact-resistant features), and the garage door’s wind resistance.

- Benefit: Homeowners can qualify for insurance premium discounts by demonstrating that their home has features reducing the risk of wind damage. It’s particularly relevant in wind-prone areas.

4-Point Inspection

Insurance companies often require this inspection of older homes to assess the condition and functionality of the four major systems of a home before issuing a homeowner’s insurance policy.

- Key Areas Examined: Roof (age, condition, life expectancy), Electrical System (type, condition, safety concerns), Plumbing System (materials, condition, updates), and HVAC System (age, condition, functionality).

- Benefit: Helps insurance companies gauge the risk associated with older homes. It can affect the homeowner’s insurance policy eligibility and rates but does not typically result in discounts.

Full Home Inspection

Provides a comprehensive overview of the overall condition of a home. It’s most commonly performed during the home buying process to inform the potential buyer about the state of the property.

- Key Areas Examined: Thoroughly examining the home’s structure, foundation, roof, electrical system, plumbing, HVAC, interior and exterior components, and sometimes additional features like pools or sprinkler systems.

- Benefit: Identifies potential issues that may require repair or negotiation before completing a home purchase. It gives a broad perspective on the home’s condition but does not directly impact insurance premiums.

Comparison Summary:

- Focus: Wind mitigation inspections target wind damage resistance; 4-point inspections evaluate the condition of four critical systems for insurance purposes; full home inspections provide a comprehensive check on the property’s overall condition for potential buyers.

- Outcome: Wind mitigation can lead to insurance discounts; 4-point inspections influence insurance policy eligibility and rates for older homes; full home inspections inform the buying decision and negotiation process.

- Applicability: Wind mitigation is essential in areas prone to high winds and storms; 4-point inspections are critical for obtaining insurance on older homes; full home inspections are a general practice in the home buying process.

How Home Insurance Companies Use Wind Mitigation Inspections

Home insurance companies use wind mitigation inspections to assess how well a home can withstand high winds and storm conditions. The inspection evaluates various features of the home, such as the roof construction, window and door protections, and other wind-resistant elements.

The results of a wind mitigation inspection can significantly influence a homeowner’s insurance premiums. If the inspection reveals that a home has sufficient wind-resistant features, the insurance company may offer discounts on the homeowner’s insurance premiums. This is because a home with wind mitigation features is less likely to suffer severe damage during a windstorm, reducing the risk for the insurance company.

In some states, such as Florida, insurance companies are legally required to provide discounts for homes that pass a wind mitigation inspection. The discount amount can vary depending on the specific wind mitigation features present in the home and the insurance company’s policies.

After the inspection, the homeowner receives a wind mitigation report, which they can submit to their insurance company. The insurance company uses this report to determine what discounts may be available based on the home’s wind mitigation features.

How Insurance Companies Determine the Cost of Wind Mitigation Credits

Insurance companies determine the cost of wind mitigation credits by evaluating your home’s wind-resistant features.

Here’s how the determination process works:

- Evaluation of Wind-Resistant Features: Insurance companies look at specific features of a home that contribute to its wind resistance. This includes the roof’s shape and construction, the strength of roof-to-wall connections, the presence of secondary water resistance barriers, and the protection of windows and doors with shutters or impact-resistant glass.

- Discounts Based on Features: The discounts offered by insurance companies vary depending on the wind mitigation features present. For example, one insurer may offer a 5% discount for clip roof attachment, while another may offer only 2% for the same feature. The more wind-resistive features a home has, the higher the potential discount on the windstorm portion of the homeowners’ insurance premium, ranging from 15% to 70%, depending on the location.

- State Regulations: In some states, like Florida, insurance companies are lawfully required to offer discounts for homes with certain wind mitigation features. This is because these features are proven to reduce the risk of damage during high wind events, thereby reducing the risk for the insurance company.

- Inspection Reports: Homeowners must obtain a wind mitigation inspection report from a certified inspector to qualify for discounts. This report documents the wind-resistant features of the home and is submitted to the insurance company for evaluation.

- Savings and Cost-Effectiveness: While the cost of a wind mitigation inspection can range from $75 to $150, the potential savings on insurance premiums often outweigh this initial expense. Homeowners can achieve significant annual credits, sometimes up to 88% off the hurricane/wind premium portion, making the inspection a cost-effective investment.

Other FAQs about Wind Mitigation Inspections

Can wind mitigation features be added to an older home?

Yes, wind mitigation features can be added to older homes. Upgrades like adding hurricane straps, impact-resistant windows, and secondary water barriers can significantly enhance an older home’s resistance to wind damage.

Is a wind mitigation inspection mandatory for obtaining homeowners insurance?

Insurance companies in some hurricane-prone areas, such as Florida, require a wind mitigation inspection to determine coverage eligibility or offer discounts.

While not always mandatory, it is highly beneficial for homeowners to obtain this inspection to qualify for insurance discounts and ensure their home is better protected against wind damage.

How long does a wind mitigation inspection take?

The duration of a wind mitigation inspection can vary depending on the size and complexity of the home but typically takes about an hour to complete. The inspector must access various home parts, including the attic, to assess wind mitigation features accurately.

What documentation is provided after a wind mitigation inspection?

After a wind mitigation inspection, the homeowner receives a report detailing the home’s wind mitigation features and any recommended improvements. This report can be submitted to insurance companies to qualify for discounts on homeowners insurance premiums.

Do wind mitigation inspections expire?

Wind mitigation inspection reports can expire. In Florida, for example, they are typically valid for five years. Homeowners should ask their insurance provider whether a new inspection is required for continued insurance discounts.

How do I prepare my home for a wind mitigation inspection?

To prepare for a wind mitigation inspection, ensure clear access to your attic, windows, doors, and garage door. Have any documents related to roofing materials, installation dates, and any previous wind mitigation improvements readily available for the inspector.

Can wind mitigation improvements affect my home’s market value?

Adding wind mitigation features to your home can increase its market value. Homes with proven resilience against high winds and storms are more attractive to potential buyers, especially in hurricane-prone areas, and can command a higher selling price.