You’re a homeowner who has worked hard to create a safe and comfortable space for you and your family. But what happens when the very foundation of your home needs repair? You might be wondering, “Does home insurance cover foundation repair?” Understanding your insurance coverage is crucial, and that’s exactly what we will delve into.

Understanding home insurance coverage for foundation repair is essential but can be complex. Coverage largely depends on the cause of the damage. Perils covered in your policy, such as fire or burst pipes, will likely be covered. However, neglect, wear and tear, and certain natural disasters may not be covered.

Understanding your homeowner’s insurance policy can feel like navigating a maze. It’s filled with terms like “dwelling coverage,” “actual cash value,” and “policy exclusions.” It’s easy to get lost. But don’t worry; you’re not alone. We’re here to guide you through this maze, to help you understand what’s covered, what’s not, and why.

Knowing whether the Insurance coverage for one’s residence covers foundation repair is more than just a piece of trivia. The knowledge could save you thousands of dollars and countless hours of stress. So, let’s dive in and uncover the truth about home insurance and foundation repair.

Get FREE quotes from local foundation repair contractors in your area today. Whether you need a pier replaced, basement waterproofing, or a full foundation replacement - We Can Help! All Contractors are screened, licensed, and insured.

Understanding Home Insurance

You’ve heard the term “home insurance” countless times. But what does it really mean? Let’s break it down. Home insurance, also known as homeowners insurance, is a type of coverage that protects your home from certain types of damage, theft, and liability.

Now, let’s delve into the specifics. What exactly does home insurance cover? Here’s a general list:

- Dwelling coverage: This covers the physical structure of your home – the walls, the roof, and the windows. It’s there for you when a storm damages your roof, or a fire ravages your kitchen.

- Personal property coverage: This protects the items inside your home. From your furniture to your electronics, it’s all covered. Even your cherished jewelry and priceless family heirlooms can be included.

- Liability coverage: Accidents happen. When they do, liability coverage steps in. It covers you if someone gets injured on your property or if you, your family members, or even your pets cause damage to others.

- Additional living expenses (ALE): Imagine a fire makes your home uninhabitable. ALE covers the costs of living elsewhere while your home is being repaired.

Sounds comprehensive, right? But here’s the catch. Not everything is covered. Certain types of damage, like floods or earthquakes, are typically not included. Regular wear and tear? That’s on you. And remember, each coverage has its limit. That’s the maximum amount your insurance will pay for a covered loss.

Now, you’re probably wondering about foundation repair. Is it covered? The answer is it depends. It depends on your policy, the cause of the damage, and whether you’ve added any endorsements (insurance speak for extra coverage) to your policy.

Consider your insurance policy as a contract. It’s an agreement between you and your insurance company. They promise to cover certain losses, and you promise to pay your premiums and meet your deductible (the amount you pay out of pocket before your insurance kicks in).

Understanding your home insurance policy is not just about knowing what’s covered. It’s about understanding your responsibilities as a homeowner, your rights, and your options. It’s about making informed decisions that protect your home, your sanctuary.

Summary

Home insurance safeguards your home from damage, theft, and liability. It includes coverage for the structure, belongings, and liability, but coverage for foundation repair depends on the policy and cause of damage. Understand your policy to know your coverage and options.

Foundation Repair and Home Insurance

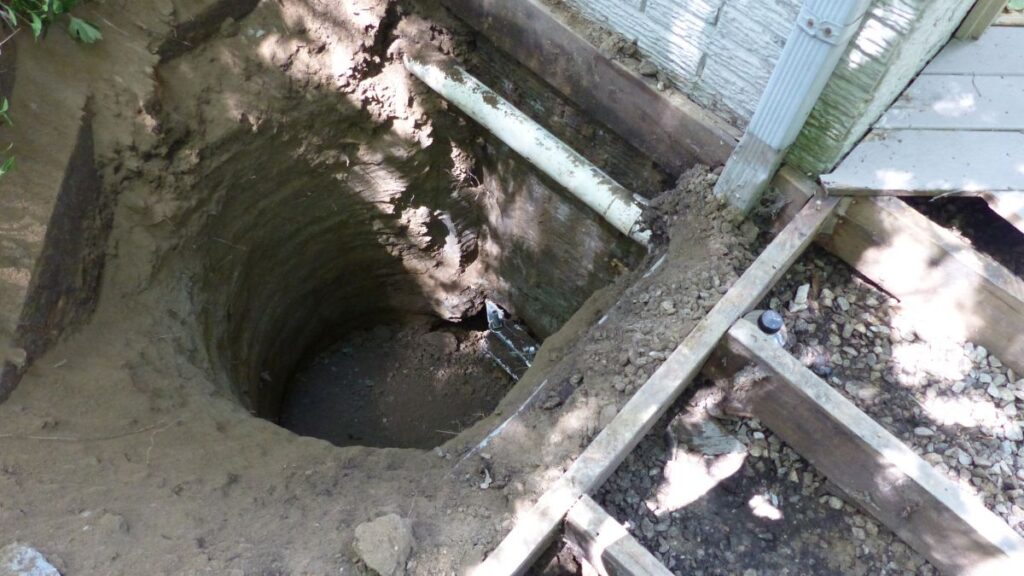

Let’s talk about foundation repair. It’s a term that can send shivers down any homeowner’s spine. Foundation repair refers to the process of fixing damage to the structural integrity of your home’s foundation. It’s a serious issue affecting your home’s safety, value, and livability.

So, what causes foundation damage? Several factors can contribute:

- Soil-related issues: Expansive clay, poor compaction, and soil erosion can all lead to foundation problems.

- Poor drainage: Excessive moisture can cause the soil to expand, putting pressure on your foundation.

- Tree roots: Large tree roots can push against your foundation, causing cracks and other damage.

- Natural disasters: Earthquakes, floods, and other severe weather events can cause significant foundation damage.

Does home insurance cover foundation repair?

The answer is a bit complex. Home insurance policies typically cover “sudden and accidental” damage. So, if your foundation damage is caused by a covered peril, such as a burst pipe or a tornado, your policy may cover the repairs.

Discover the estimated cost of your project: Slab Foundation Repair Cost: A Comprehensive Guide

Here are some instances when home insurance might cover foundation repair:

- Water damage: If a plumbing leak causes your foundation to crack, your home insurance may cover the repairs.

- Fire: If a fire damages your home and its foundation, your insurance may cover the cost of repairs.

- Vandalism: If someone intentionally damages your home’s foundation, your insurance may cover the repairs.

But remember, every policy is different. It’s essential to read your policy and understand what’s covered and what’s not.

On the flip side, there are instances when home insurance will not cover foundation repair:

- Neglect: Home insurance doesn’t cover damage due to neglect. If you’ve ignored a small crack in your foundation and it’s grown into a larger problem, your insurance likely won’t cover the repairs.

- Earth movement: Damage caused by earth movement, including earthquakes and landslides, is typically not covered by standard home insurance policies.

- Floods: Standard home insurance policies do not cover flood damage. If a flood causes your foundation to crack, you’ll need separate flood insurance to cover the repairs.

- Normal wear and tear: Over time, it’s normal for your home to settle and small cracks to appear in your foundation. This is considered normal wear and tear and is not covered by home insurance.

Summary

Foundation repair involves fixing structural damage to a home’s foundation. Home insurance may cover sudden and accidental damage caused by certain perils like water damage, fire, or vandalism. However, neglect, earth movement, floods, and normal wear and tear are generally not covered. Review your policy to understand coverage.

For more in-depth information, you can check the following related article: Home Insurance Inspection: 13 Things You Should Know

Factors that Influence Coverage

Regarding your home insurance coverage, not all policies are created equal. Several factors can influence what’s covered and what’s not. Let’s delve into some of these key factors.

- Understand the terms and exclusions of your policy: These are the game’s rules. They outline what your insurance will cover and what it won’t. For instance, your policy might exclude certain “high-risk” perils like floods or earthquakes. Or it might limit the amount it will pay for certain property types, like jewelry or electronics.

- Consider the role of maintenance and negligence: Home insurance is not a maintenance contract. It’s there to protect you from sudden and unexpected events, not problems that arise from neglect or lack of maintenance. So, let’s say you’ve noticed a small crack in your foundation but chose to ignore it.

- Natural disasters and “Acts of God”: These events are out of your control, like hurricanes, tornadoes, and earthquakes. While standard home insurance policies cover some natural disasters, others are not.

- Additional coverage options: You can add extras to your policy for more protection. For example, you might add an endorsement (also known as a rider) to increase your coverage limits or cover perils not included in your standard policy.

Here’s a quick recap:

- Policy terms and exclusions: These define what’s covered and what’s not.

- Maintenance and negligence: Neglecting maintenance can lead to denied claims.

- Natural disasters and “Acts of God”: Some are covered, and others require separate policies.

- Additional coverage options: These can add more protection to your policy.

Understanding these factors can help you maximize your home insurance policy. It can help you avoid surprises, make informed decisions, and protect your home and financial well-being. Remember, insurance is a tool for protection, not a maintenance contract. Use it wisely, and it can serve you well.

The Process of Claiming Foundation Repair on Home Insurance

Discovering foundation damage can be a heart-stopping moment. But don’t panic. You’ve got this. Let’s walk through the steps to claim foundation repair on your home insurance.

- Assess the situation: Take a deep breath and inspect the damage. Document everything. Take photos, make notes, and gather evidence supporting your claim.

- Review your policy: Ensure you understand your coverage before filing a claim. Look for any terms, exclusions, or limits that might apply. This can help you set realistic expectations and prepare for the claims process.

- Contact your insurance company: Most companies have a 24/7 claims hotline. When you call, be ready to provide details about the damage and your policy information.

- An insurance adjuster will likely visit your home to investigate the damage: This person’s job is to verify your claim and assess the extent of the damage. They might take photos, ask questions, and take notes.

- During the investigation, the adjuster will determine whether the damage is covered under your policy and estimate the cost of repairs: They’ll consider factors like the cause of the damage, the extent of the damage, and your policy terms and exclusions.

- The insurance company will make a decision: If your claim is approved, they’ll issue a payment for the repair costs minus your deductible. If your claim is denied, they’ll provide a reason for the denial.

But what if your claim is denied? Don’t lose hope. You have three options:

- Review the denial: Make sure you understand why your claim was denied. Was it due to a policy exclusion? Was there a mistake in the investigation? Understanding the reason can help you determine your next steps.

- Appeal the decision: If you believe the denial was unjust, you can appeal the decision. This usually involves providing additional evidence or clarification.

- Consult with a professional: If you’re unsure what to do, consider consulting with an insurance professional or a lawyer. They can provide advice and help you navigate the process.

Key points about Claiming Foundation Repair on Home Insurance

1. Assess the damage and gather evidence.

2. Review your insurance policy for coverage details.

3. Contact your insurance company and provide necessary information.

4. An insurance adjuster will investigate the damage and assess coverage.

5. The insurance company will make a decision: approve the claim or provide a denial reason.

6. If denied, options include reviewing the denial, appealing the decision, or seeking professional advice.

FAQs About Home Insurance Coverage and Foundation Repairs

When researching whether or not a home insurance policy will cover foundation repair, you probably have many questions. Here are a few frequently asked questions.

Does homeowners insurance cover cracked walls?

Homeowners’ insurance coverage for cracked walls depends on the cause and policy terms. Covered perils like natural disasters may be included, while wear and tear or settling/foundation issues are typically not covered.

What are the signs of foundation issues?

Signs of foundation issues include cracks in walls, floors, or ceilings, uneven or sloping floors, sticking doors and windows, visible gaps between walls and the floor or ceiling, bowed or leaning walls, moisture or mold issues, and deteriorating concrete.

When does your insurance cover foundation damage?

Home insurance may cover foundation damage caused by covered perils like fire or certain types of water damage. However, it typically excludes normal wear and tear, soil compaction, poor construction, and lack of maintenance.

Does your homeowner’s insurance cover foundation repairs?

Homeowner’s insurance typically covers foundation repairs for certain perils, such as fire or specific water damage. However, it usually excludes coverage for normal wear and tear, earth movement, poor construction, or lack of maintenance.

Does homeowners insurance cover foundation repairs?

Homeowners’ insurance coverage for foundation repairs varies based on the cause of the damage. Insurance may cover the repairs if a covered peril, such as a natural disaster, causes the damage.

Conclusion

Navigating the world of home insurance and foundation repair can seem daunting. But with the right knowledge and understanding, you can confidently handle any foundation issues that come your way. Remember, your home insurance policy is a contract designed to protect your home from unexpected events. It’s not a maintenance contract, and it doesn’t cover everything.

Understanding the specifics of your policy, the factors that influence coverage, and the process of filing a claim can empower you to make informed decisions. If you’re ever in doubt, don’t hesitate to contact insurance professionals or legal.